Student Loan Debt & Longevity Planning

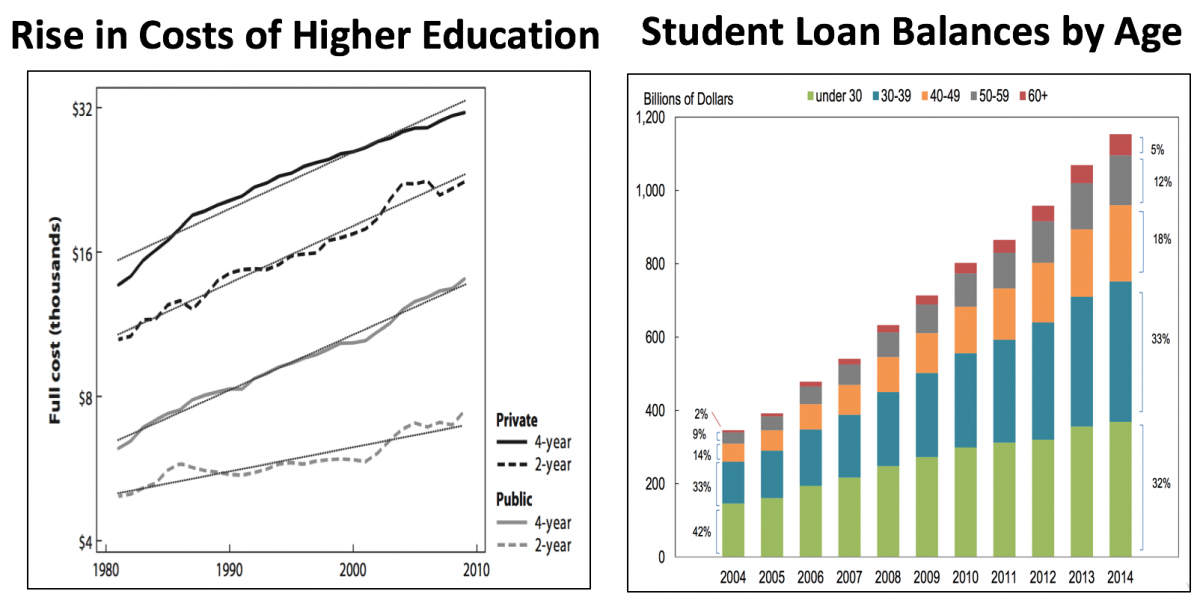

The rising number of Americans who take out student loans - and the increasing size of those loans in accordance with ballooning tuition costs - is shaping a generation of college graduates. The effect of student loan debt on decisions such as moving out of the family residence, buying a home, getting married, and having children has been well-documented. But there may be further impacts of large-scale student debt that have gone relatively unexplored.

The AgeLab organized focus groups of student loan borrowers, organized by age group and by level of debt, to better understand how student debt is shaping peoples' life decisions and relationships across the life course.

In particular, the study explored the information-gathering and decision-making that people undergo prior to taking out loans, the effect of student loan debt on family relationships, the way that debt affects how people plan for and save for retirement, and how the burden of debt impacts their socioemotional and physical health and financial well-being.

This study is one of the first to explore the intersection of student debt and retirement planning, and is the first to explore these concepts through a mixed-methods approach and with borrowers of different ages.

Publications

Balmuth, A., Miller, J., Brady, S., D’Ambrosio, L., & Coughlin, J. (2021). Mothers, Fathers, and Student Loans: Contributing Factors of Familial Conflict Among Parents Repaying Student Loan Debt for Children. Journal of Family and Economic Issues, 42(2), 335-350.

Miller, J., Brady, S., Balmuth, A., D’Ambrosio, L., & Coughlin, J. (2021). Student Loans at the Dinner Table: Family Communication Patterns About Student Loans Before Accrual and During Repayment. Journal of Family and Economic Issues, 42(2), 251-271.

Take the Next Step

Make innovation possible - Learn how you can contribute to AgeLab research.