Reshaping financial planning through a co-creation workshop

The financial advisory profession is tasked with guiding clients toward investing in their future selves – and imagining what that future will look like. But do advisors have the tools to connect with clients and accomplish these challenging tasks?

The AgeLab has been working on designing new tools to help advisors engage clients in new kinds of conversations. As part of this project, I organized a co-creation workshop of professional designers to design future financial planning toolkits and services for financial advisors and their clients.

Each co-creation workshop section consisted of a group of two designers from different disciplines: industrial/product design, branding, interaction design, business design, design strategy, and graphic design, to address two questions from service providers’ (financial advisors) and service recipients’ (clients) perspectives:

- How might we envision a financial planning toolkit and services to empower financial planners with a set of skills and mindset to understand clients’ desires, build empathy and trust with them, and provide tailor-made financial products for them?

- How might we envision a future financial planning toolkit and services for an aging population to help the conversation be more transparent, enable older adults to be more explicit to express their needs, and build friendship and trust with financial planners?

This blog post covers two aspects of the workshop: 1) co-creation: how the workshop was designed to generate new ideas; and 2) content: participants’ reflections after brainstorming ideas around financial planning toolkits and services for an aging population.

1) CO-CREATION: How was the workshop itself designed?

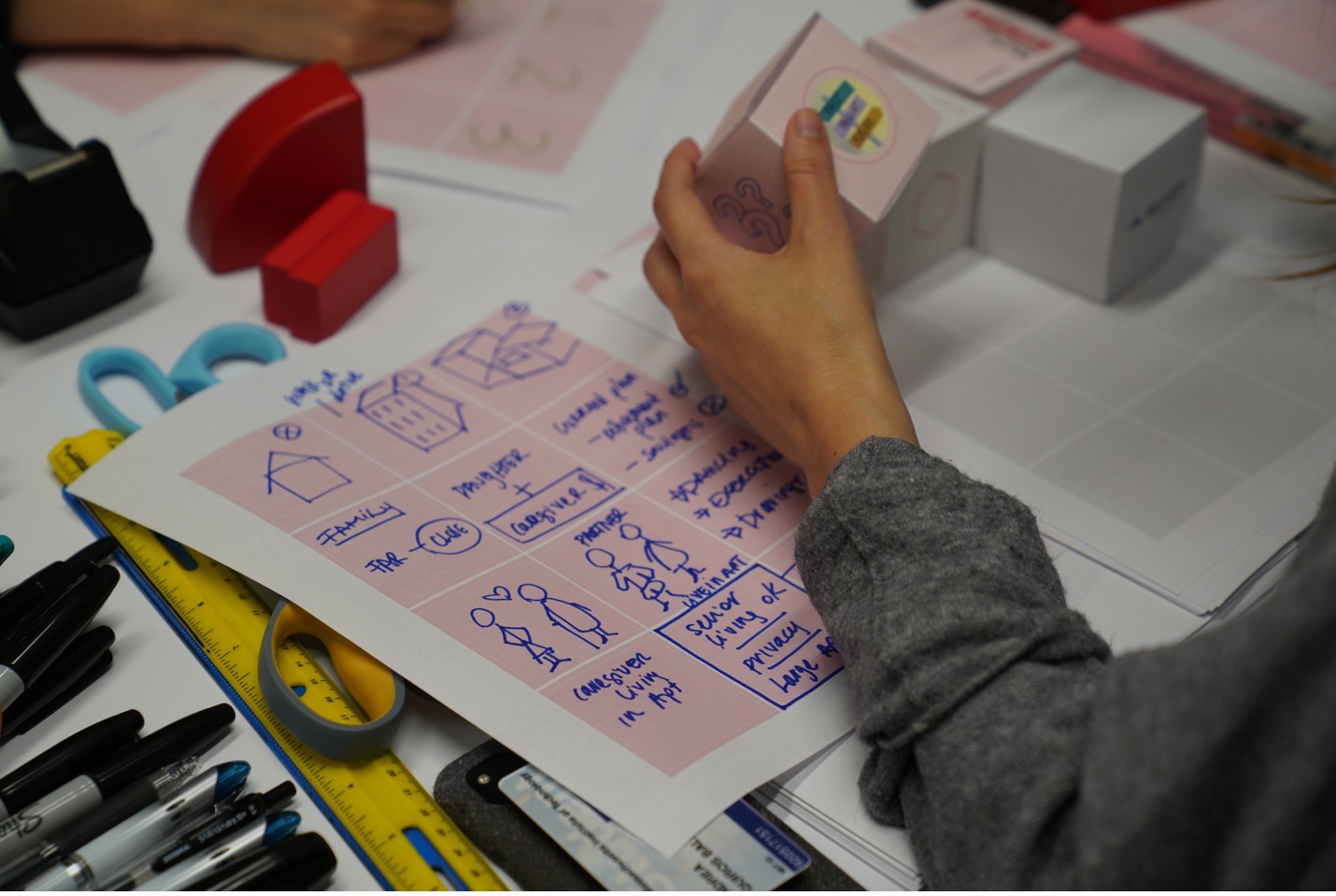

When you go to a presentation or meeting, it is easier to get people’s attention if you bring something physical to touch, play, rotate, build, and hold. All these activities make people “feel” not only the texture of the tangible products, but also the ideas themselves that the objects represent, and triggers people to discuss their thoughts openly. For the workshop, we provided the participants with co-creation tools: letter-size paper, Post-it notes, Sharpies, tapes, scissors, and simple templates.

Not only focusing on the co-creation tools, we also considered the location (1 Amherst St, Cambridge, MA 02142), the size (approximate 323 square feet), and the view (with sunlight and two windows) of the co-creation workshop space. For a two-person co-creation workshop, the space cannot be huge and echoing, but it needs to have a big enough table for prototyping and installing recording devices (e.g., one 360 GoPro, one iPhone, one MacBookPro for Zoom recording, and one Sony camera) for observation. We also chose a room with natural sunlight, so the participants wouldn’t feel that they are stuck in a box.

We also designed the “software” part of the workshop, including creating challenging briefing materials, co-creation guidance, and selected reference frameworks. One participant commented, “I think the three briefing videos before the co-creation workshop helped a lot. Honestly, it helps us quickly get into the right mindset.”

Another decision we made for the workshop was to instruct the two designers to roleplay as advisor and client – and to switch between roles. In response to this, one participant shared, “The role-playing [of advisor and client] helps to sort of switch and immediately change mindsets, because then you were like, ‘Oh, this person needs a lot more empathy in the way they're treated.’ But then the financial advisor doesn't have that kind of time.” Another designer echoed these thoughts: “So it’s really great, the collaboration, to take in each part (financial advisor and client) as a role, like, you know, role-playing, and then put ourselves in their shoes and think from their perspective.”

Participants also want to have a way or structure to ask for help or someone who can answer their questions during the co-creation session. The organizer of the workshop (me) made himself available for questions at any time. “It’s kind of helpful that you were around in the co-creation workshop with us. So if we had questions we could ask you. If you just left us in the room and went outside, it’s still okay, but I think the flow and the vibe of the co-creation workshop space will be different,” said one participant.

2) CONTENT: What impressions and ideas arose from the workshop participants?

What are the impressions, perceptions, ideas, and models of financial planning services and toolkits from the perspectives of designers? Participants summarized their preliminary views in the pre-workshop survey:

"A service designed to help understand and realize a person’s financial goals."

"A tool that gives me actionable plans to meet my goals and needs.”

"A system of expert individuals and digital tools to plan for my long-term financial health."

Others gave ideas based on milestones in their lives:

"Planning my life ahead of time in terms of finances I will need in the future, based on the planning when I can retire and have a sufficient amount of money by working towards this goal from now with the help of the service."

"Providing general information about finance and helping me build the plan tailored to me for the future."

Others discussed their ideas from the service design perspective:

"A service that helps me organize my finances and plan for a better and less stressful future."

"Something that helps me plan my current and future cash flows to make sure I'm enjoying my present life while allocating appropriate rainy-day funds and retirement funds."

"A service that helps me create a balance in using my financial resources in a way that I am able to have a great present, while making sure there are enough rainy-day funds and short-term and long-term future security."

During the workshop, participants reflected not only on the end result of the advisor-client interaction (design solutions), but also discussed root causes of the design challenge (e.g., trust, establishing a relationship). “There are so many ambiguities and uncertainties when we get old, especially about our financial planning services. How do you trust the financial advisor when you know you really need it? How to build trust?” one participant asked.

Another designer also highlighted that financial planning services and toolkits are based on trust and connections. It’s a business of people and their lives. “I think the first [step] is building trust with [clients] because I think when you are getting old, one is really worried about their health. And the second one is about their financial situation. If financial planning can actually help them, with not only managing their health care but also their financial aspects. it will care more about their life, their feelings, and their emotions, and then it can really support the discussion with financial advisors. That’s why we think it’s critical to design a pre-check system to help financial advisors support all aspects of their lives, not only emphasizing these two.”

Financial planning is a big term for most of our participants and could be overwhelming. We think it’s a context-dependent word and varies from person to person considering their backgrounds, education, families, countries, industries, and more. One participant shared, “I think that even the term financial planning can be very intimidating, can be very overwhelming. How much money do I have? Is it enough? And then what do I do with it? And who can I trust to advise me on that process? So I think at every stage of life we have these questions. If we're talking about the US, specifically, I am thinking about healthcare costs and thinking about these other, maybe not unexpected costs, but the costs that we haven't had to deal with in other parts of our lives can be extremely daunting as well.”

We observed across the four workshops that the proposed design solutions were less about providing the perfect solution. Instead, they addressed how to create more meaningful and quality conversations between the financial advisors and clients: “I feel like our form concept is a Russian doll. Our design intention is a process to understand what our target audience's financial goals are layer by layer and step by step. We also consider how seniors plan for a long-term goal, and as the same as people do their short-term planning.”

Another participant echoed these thoughts: “We were not restricted to thinking about explaining the financial service, but more interested in how we can create a physical tool for financial advisors to spend more time with clients.”

We still have plenty of room to improve, think about, and design our toolkit. By starting from the users' needs in an empathetic position, we could ask and frame the right questions to address challenges that this project poses for us as researchers and designs.