Evolving Client-Adviser Conversations and the Future of Advice

by Adam Felts

AgeLab researchers have published a paper in the Journal of Financial Planning on changes in perceptions of the role of the financial adviser - among both clients and advisers themselves.

The paper, titled "Evolving Client-Adviser Conversations and the Future of Advice," draws on data from two surveys - one of clients, the other of financial advisers.

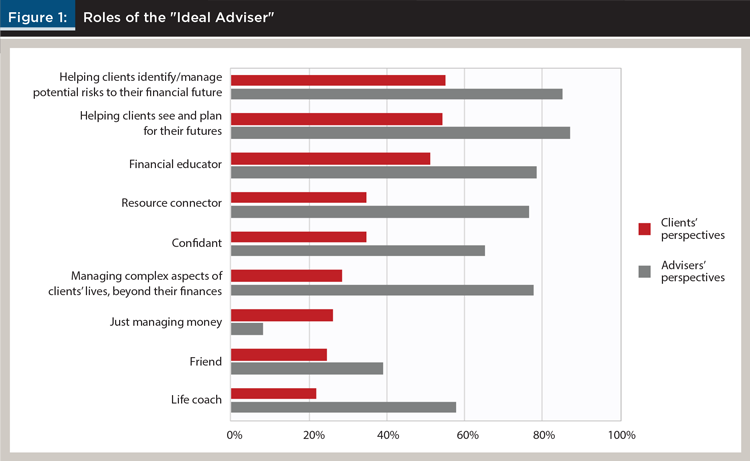

The two groups of respondents were asked the roles they thought that the 'ideal' financial adviser would take on in their relationships with clients, with options including 'resource connector,' 'confidant,' and 'just managing money,' among others. Both groups were also asked about what topics of conversation they were willing to have in the client-adviser setting, with topics such as the client's physical health, the client's family members, and the client's housing situation.

The client and adviser respondents showed some alignment in their views, but key differences also arose. Both groups selected the same top three roles for the 'ideal' financial advisor: helping clients identify/manage potential risks to their financial futures, helping clients see and plan for their futures, and financial educator. But clients were far more likely than advisers to choose 'just managing money' as the role of the ideal financial adviser, suggesting that clients may have more traditional views of the financial advice profession. Clients also showed less willingness than advisers to talk about non-traditional topics, although most clients were still generally willing to discuss any topic. Significantly, over 95 percent of clients who had already discussed a topic were willing to discuss that the topic again, suggesting that having the conversation did not overstep the boundaries of the client-adviser relationship for them.

Overall, the results suggest both an opportunity for advisers to expand their role and also grounds for caution when navigating unfamiliar topics with clients. Initiating more comprehensive longevity planning discussions may require advisers to be trained to engage in new kinds of conversations with clients.

The paper features Lexi Balmuth, Lauren Cerino, Julie Miller, Adam Felts, and Joseph Coughlin as authors.

Read more via the Financial Planning Association.